GL - Multi Coy Balance Sheet

Overview

The TASS.web General Ledger 'Multi Coy Balance Sheet' program produces a 'Group' Balance Sheet that consolidates multiple companies (schools) into a single Balance Sheet.

This program is for TASS.web Enterprise only.

This Balance Sheet program has extensive options that can be activated via run-time settings. These settings can be saved as a report 'Configuration'.

You can save more than one 'Configuration'.

As an example, you might save different configurations including:

Formats with a different set of 'Included Companies'.

A detailed version of the multi-company Balance Sheet.

A consolidated version of the multi-company Balance Sheet etc.

Pre-requisites

Some of the underlying assumptions for this to work for your 'group' of schools:

One company in your group (and only one company) must be set up as a 'source' company.

To set up a source company, log into the appropriate company and use TASS.web Finance > General Ledger > Setup Information > Company Information. Tick the 'Is this the Source Company for Multi-Company financial reports?' box.

The source company is very important because the multi-company Balance Sheet is based on the GL setups for that company:The chart of accounts and reporting codes used on the report are taken from the source Company Code (not the company code of the logged-in user).

The Company Name and Logo are taken from the source Company.

All companies that are to be included in this report must have:

Matching Chart of Accounts. This means that the Asset, Liability and Net Worth account codes in the companies that you are including in your multi-company Balance Sheet must also exist in the source company.

Identical Account Types. This means that the account type for the Asset, Liability and Net Worth accounts must match the account type on the same account code in the source company.

Balance Sheet

Use this option to produce a single Balance Sheet for multiple companies (schools).

Important!

The use of reporting codes in separation or consolidation functions is determined by the setup in the source company.

General Tab

Report Layout | Source Company | This is a display-only field. One company in your group (and only one company) must be set up as a 'source' company. |

Included Companies | Companies that have been set up to be included in multi-company financial reports will be available here for selection. You can select/deselect the companies that you want to include in this report. | |

Balance Sheet | Check the 'Balance Sheet' radio button. | |

Selection Criteria | Select the 'Year', 'Period', 'Budget Number' and 'Prior Year Comparative Period' for your report. |

Print Tab

Formatting Options |

| Choose the 'destination' of the report. The 'Screen with Hyperlinks' format is best if you need to 'drill-down' to further information. To enable this option, tick the Multi-Company Option 'Include Detailed Line for each Company' (see below) so you can 'drill-down' to the account records once the report has been generated. |

Show Table Borders and Alternative Row Colours | The 'Table Borders' and 'Alternate Row Colours' options can enhance the readability of the report but are not available if the listing destination is Excel®. | |

Report Options | Include Variance Column | Tick this box to print a variance column on your Balance Sheet (budget against balance for each account). This box will only become active if you have selected a budget on the 'General' tab. |

Print Account Codes | Check this box if you want to include the account code on your Balance Sheet. | |

Include Accounts with Zero Balances | Leave unchecked to exclude zero balance accounts from the report. | |

Separate by Reporting Code 2 | Reporting Code 2 (Financial Statements - Separation Codes) has been reserved to separate the Balance Sheet into distinct reporting sections such as 'Current Assets', 'Current Liabilities', 'Non-Current Assets' and 'Non-Current Liabilities'. Hence, Reporting Code 2 is used for a higher level of 'break' in the data than Reporting Code 3. Reporting Code 2's are set up using a similar methodology as outlined in this documentation for setting up Reporting Code 3's. | |

Group By | The default for the Balance Sheet is to group accounts based on 'Reporting Code 3'. Reporting Code 3 (Financial Statements - Grouping/Consolidation Codes) has been reserved to classify the individual 'Asset', 'Liability' into distinct subheadings within the Balance Sheet plus to classify any 'Accumulated Funds and Reserves' Accounts Asset Section Example:

Liability Section Example:

Refer to the guide 'How to Setup Reporting Code 3 for Grouping/Consolidation on the Balance Sheet' for details on setting up reporting code 3. Alternatively, you can elect to group by reporting codes 1 or 4. | |

Consolidation Options | No Consolidation | This is the default for the program and the report will show all account codes separately. |

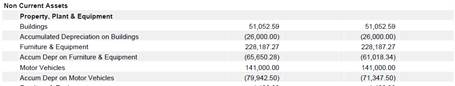

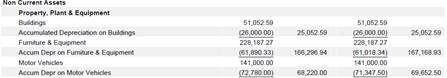

Offset Associated Accounts | This function is mainly used to offset accumulated depreciation accounts against their associated asset accounts. This is an example of a Balance Sheet without the offset function:  This is an example of a Balance Sheet with the offset function:  Refer to the guide 'How to Setup Account Offset Associations' for details on setting up account associations. | |

Consolidate on Chart Code | When checked, this option will consolidate the line items shown, based on the 'Chart' section of the GL structure within each account code. The description for each line item will be taken from the account description from the first account (within the source company) used in the consolidation. In the example below, consolidation would occur at the '6200' chart level and the Line Description would display 'Debtors'.

This option is not able to be checked when the 'Consolidate on Reporting Code 3' box is checked and vice versa. | |

Consolidate on Reporting Code N | You would use this option where you need consolidation to occur on accounts within the 'Group By' sections. This documentation refers to this as 'Mid or Custom' level consolidation. Example You have used Reporting Code 3 to break the liability section into the headings suggested in the example in the 'Group By' field above. Liability Section Example:

Under the 'Creditors' section, you have several clearing accounts for Superannuation.

You want to include a single figure on your Balance Sheet for the total of all of your Superannuation clearing accounts. In this example, you need to group on the Reporting Code 3 but need to consolidate on a different Reporting Code, e.g. Code 6. To achieve this, the various Superannuation clearing accounts need to be attached to Reporting Code 6. Therefore you elect to:

| |

Consolidate on Reporting Code 3 | This will set the consolidation for your report to the Reporting Code 3 level. | |

Multi-Company Options | Include Detailed Line for each Company | Check this box if you want to include a separate line for each company for each account displayed on the report. Use this option with Formatting Option 'Screen with Hyperlinks'. |

Report Title | This defaults to 'Multi Company Balance Sheet as at DD/MM/YYYY' and can be overridden with a different title. | |

Report Sub Heading | This defaults to print the companies selected on the 'General' tab directly under the 'report' title, e.g. Companies 10,11,12. You can override this with a different subheading of up to 200 characters. | |

Save this Configuration as | To save the settings that you have entered as a re-usable report configuration enter a meaningful description in this field. |

Period Balances Report

This produces a report in a landscape format that includes the budget (for the last period in the selected year) and balance figures for each period (usually 1 - 12).

General Tab

Report Layout | Source Company | This is a display-only field. One company in your group (and only one company) can be set up as a 'source' company. |

Included Companies | Companies that have been set up to be included in multi-company financial reports will be available here for selection. You can select/deselect the companies that you want to include in this report. | |

Period Balances Only | Check the 'Period Balances Only' radio button. | |

Selection Criteria | Select the 'Year' and 'Budget' (number) for your report. |

Print Tab

Because you have elected to run this report as 'Period Balances Only' on the 'General Tab', the options that are available on this tab are limited.

Formatting Options |

| Choose the 'destination' of the report. The 'Screen with Hyperlinks' format is best if you need to 'drill-down' to further information. To enable this option, tick the Multi-Company Option 'Include Detailed Line for each Company' (see below) so you can 'drill-down' to the account records once the report has been generated. |

Show Table Borders and Alternative Row Colours | The 'Table Borders' and 'Alternate Row Colours' options can enhance the readability of the report but are not available if the listing destination is Excel®. | |

Report Options | Include Variance Column | Only available on the Balance Sheet report. |

Print Account Codes | Check this box if you want to include the account code on your 'Period Balances' report. | |

Include Accounts with Zero Balances | Leave unchecked to exclude zero balance accounts from the report. | |

Separate by Reporting Code 2 | Only available on the Balance Sheet report. | |

Consolidation Options | All Consolidation Options | Only available on the Balance Sheet report. |

Multi-Company Options | Include Detailed Line for each Company | Check this box if you want the report to have a separate line for each company for each account included. Use this option with Formatting Option 'Screen with Hyperlinks'. |

Report Title | This defaults to 'Multi Company Period Balances for YYYY' and can be overridden with a different title. | |

Report Sub Heading | This defaults to print the companies selected on the 'General' tab directly under the 'report' title, e.g. Companies: 10,11,12. You can override this with a different subheading of up to 200 characters. | |

Save this Configuration as | To save the settings that you have entered as a re-usable report configuration enter a meaningful description in this field. |