How to Setup Account Offset Associations

This function is mainly used to offset accumulated depreciation accounts against their associated asset account on the Balance Sheet.

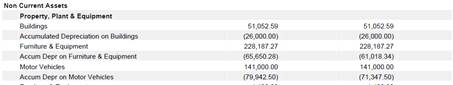

This is an example of a Balance Sheet without the offset function:

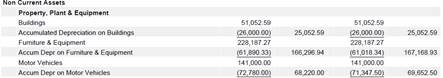

This is an example of a Balance Sheet with the offset function:

Step | Menu Path | Details | ✅ |

|---|---|---|---|

1 | TASS.web Finance > General Ledger > Listings & Reports > Balance Sheet. | Run your Balance Sheet to identify the accounts to offset. On the 'Print' tab tick the 'Print Account Codes' and 'Include Hyperlinks' boxes. | 🔲 |

2 | TASS.web Finance > General Ledger > Listings & Reports > Balance Sheet. | Identify the first 'Accumulated Depreciation' account that you need to associate to an asset account. In the example above it would be 'Accumulated Depreciation on Buildings'. Make a note of the asset account code that the accumulated depreciation account is to be associated to. Use the hyperlink on this 'Accumulated Depreciation' account on the report to drill down to the 'Account Info' screen. | 🔲 |

3 | TASS.web Finance > General Ledger > Listings & Reports > Balance Sheet. | Click the 'Edit' button on the 'Account Info' screen and navigate to the 'Reporting Codes' tab. Use the 'Associated to' field to enter the asset account code that this accumulated depreciation account is to be associated to (the one that you noted in Step 2). Click the 'Save' button. | 🔲 |

4 | TASS.web Finance > General Ledger > Listings & Reports > Balance Sheet. | Re-run your Balance Sheet. On the 'Print' tab tick the 'Offset Associated Accounts' box. Check that the accumulated depreciation account is correctly offset against the asset account. | 🔲 |

5 | Repeat Steps 1 to 3 for the remainder of your accumulated depreciation accounts. | ||